Sritama Ray had chosen Testonomics as her Preparation Partner for the RBI DEPR 2023 Exam. She was enrolled in : (1) Statistics and Econometrics Course (2) Microeconomics Course (3) English Essay Course (4) RBI DEPR Test Series (5) Interview Guidance Programme

Greeting to all aspirants of the RBI DEPR Exam. My name is Sritama Ray and I have qualified the RBI DEPR 2023 Examination. I have completed M.A. Economics from JNU and M.Phil from IGIDR. Presently, I am pursuing PhD (Economics) from IGIDR. Today, I am sharing my RBI DEPR Interview Transcript with You. I hope this adds value to your preparation of RBI DEPR Exam.

Let’s begin !

RBI DEPR Interview Transcript

Name: Sritama Ray

Marks in Interview: 67 / 75

Duration: 20-25 minutes

I entered. There were six members in the Panel – two females and four males. I was asked to sit. I greeted everyone, they greeted me back and smiled.

Chairman (looking at my biodata) :

1. So… Kolkata, then JNU…Delhi and now Mumbai, you have travelled quite a bit around the country. Do you know Marathi?

Ans: No, Sir.

2. It says here that you have published two G20 policy briefs, can you tell us about them?

Ans: I told them about the policy briefs – started with the topic, why it is important, what we found, and what our recommendations were.

3. So, you are doing your PhD now or is it completed?

Ans: Told them that my M.Phil. is completed and my Ph.D. is ongoing, both from IGIDR.

Female 1:

- RBI has published something about IGIDR on their website yesterday. Can you tell us what it is?

Ans: Talked about the 19th convocation ceremony of IGIDR, attended by the RBI Governor and Principal Secretary to the hon’ble Prime Minister.

- What are the different types of unemployment?

Ans: Talked about Structural, Frictional, and Cyclical unemployment. Explained each.

- What does NaBFID stand for? What does NaBFID do? When was it established?

Ans: I could answer each question in short sentences.

Male 1:

- (Talked about monetary policy transmission for a bit and then asked): What are the ways in which monetary policy transmission can be improved in India? Except for the things that have already been done? What type of loan is not linked to EBLR?

Ans: I answered it and mentioned a paper by Viral Acharya on monetary policy transmission channels that I had read recently. Could not answer which type of loan is not linked to EBLR (he said ‘that’s fine’).

- Lately we are seeing central banks all around the world increase their holdings of gold. Why do you think that is?

Ans: Talked about de-dollarisation, dollar enjoying ‘exorbitant privilege’, the fact that gold is a safe haven asset and investments in gold generally go up during times of global economic and political uncertainty (he said ‘good’, ‘very good attempt’, etc.)

Male 2:

- Your first policy brief was on exchange rate volatility, and what?

Ans: The chairman answered on my behalf, and then I elaborated on the answer – risk perception of global investors about emerging market assets.

- Why is volatility bad?

What is RBI’s official stance on exchange rate management?

Why do you think curbing excess volatility is required?

Why is there more buying of dollars as opposed to selling of dollars by RBI?

Is reserves the only motive?

Ans: Could answer everything. Talked about policy uncertainty, exchange rate risk, hedging, investor risk perception, asymmetric intervention, Indian currency being on US treasury’s watchlist etc.

Female 2:

- Tell us about the data used for macroprudential regulations in your work.

Ans: I told her about an IMF database, the number of instruments covered, the way I used the data, what I expected to find, etc.

- Why are you working with macroprudential regulations?

Ans: Explained my motivation.

(She also discussed a recent prudential measure taken by RBI which I was aware of, so I could join her in the discussion.)

Male 3:

- …You said global financial what? Crisis? Oh, shocks.

What is the time period of your analysis? What did you see for US?

If you had looked at ’70s data maybe you could have found more regulations because they were going through a crisis during that period.

What is your sample? How many countries?

Ans: It was a straightforward discussion on my Ph.D. work, so I explained the best I could.

- I see here that you have asked for 2 additional increments. But we do not give joining increments unless you have finished your Ph.D. or you have worked in a corporate job for a long time.

This does not mean we are recommending your name. I am not saying that. I am just telling you.

Ans: I smiled and said, ‘that’s alright, Sir.’

Chairman: Ok. You can leave now.

I thanked everyone and left.

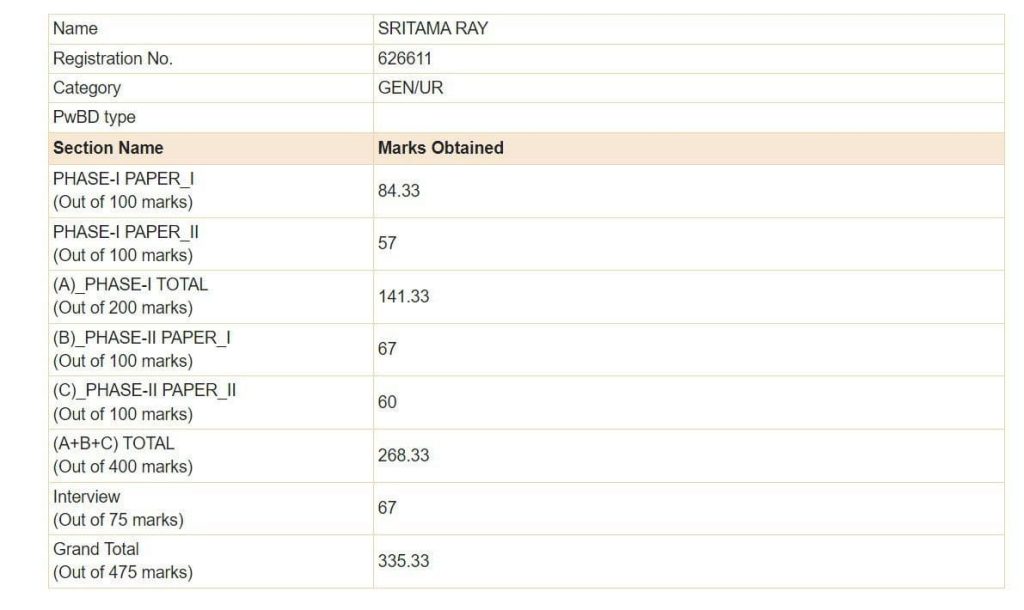

My Marksheet is attached below :